Weekly Market Commentary – 9/24/2021

-Darren Leavitt, CFA

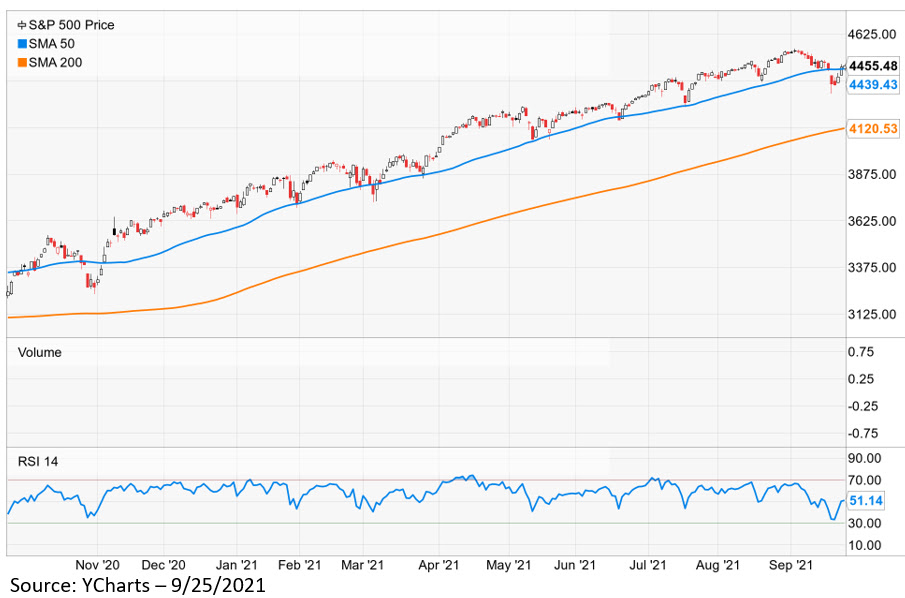

Financial markets had a rollercoaster ride over the week that started on fears that one of China’s largest land developers would default on their debt which stoked rhetoric of a systematic breakdown in the global markets. The week started with the S&P 500 down nearly 3%, but a subsequent late-day rally cut the early-day losses in half. Additionally, the market looked vulnerable after closing below its 50-day moving average last Friday. But a constructive tone out of the Federal Reserve’s September FOMC meeting coupled with the realization that Evergrande’s default had minimal exposure to global banks led “buy” the dip investors back into the markets. However, concerns regarding Washington’s inability to get an increase in the debt ceiling remain. Economic data for the week continued to come in a bit better than expected, which also helped the markets recover.

For the week, the S&P 500 managed a 0.5% increase, the Dow led gainers with a 0.6% advance, the NASDAQ lagged its peers with a gain of 0.2%, and the Russell 2000 added 0.5%. The US yield curve steepened on Fed rhetoric and better than expected economic data. The 2-year note yield increased four basis points to close at 0.27%, while the 10-year yield increased nine basis points to 1.46%. 30-year paper closed with a yield of 1.99%. Gold was unchanged on the week. Oil prices continued to climb. WTI prices increased 2.8% or $2.08 to close at $74.00 a barrel. The price increase helped push the Energy sector up 4.7% for the week. Notably, Cryptocurrencies took a hit on the week on news that there had been another hack to the system and more so on news that the Chinese government would ban Bitcoin and crack down further on illegal mining.

Economic data reported during the week was constructive. The housing market still appears to be doing quite well. New Home Sales, Existing Home Sales, Housing Starts, and Permits all beat expectations. Preliminary September Markit PMI data for Manufacturing and Services showed continued expansion coming in at 60.5 and 54.4, respectively. August Leading Indicators came in at 0.9 versus the consensus estimate of 0.6. Finally, high-frequency data on unemployment continue to show trending improvement. However, Initial Claims missed the mark coming in at 351K versus the estimate of 315k. Continuing Claims came in at 2.845 million.

Investment advisory services offered through Foundations Investment Advisors, LLC (“FIA”), an SEC registered investment adviser. FIA’s Darren Leavitt authors this commentary which may include information and statistical data obtained from and/or prepared by third party sources that FIA deems reliable but in no way does FIA guarantee the accuracy or completeness. All such third party information and statistical data contained herein is subject to change without notice. Nothing herein constitutes legal, tax or investment advice or any recommendation that any security, portfolio of securities, or investment strategy is suitable for any specific person. Personal investment advice can only be rendered after the engagement of FIA for services, execution of required documentation, including receipt of required disclosures. All investments involvement risk and past performance is no guarantee of future results. For registration information on FIA, please go to https://adviserinfo.sec.gov/ and search by our firm name or by our CRD #175083. Advisory services are only offered to clients or prospective clients where FIA and its representatives are properly licensed or exempted.